new

Carriers

International Shipping

All Plans

Supporting the new Import One-Stop Shop (IOSS) regulation 🇬🇧

The current VAT rules state that no import VAT must be paid for commercial goods with a value of no more than €22. From 1 July 2021, this rule will be abolished, and all goods imported into the EU will be subject to VAT regardless of value.

In the last month we’ve been making sure that we are compliant with the new

IOSS (import-one-stop-shop) regulation

that went into effect. In our case, this affects our UK merchants, as this is our only active non-EU market for now.What is the IOSS for?

The

Import One-Stop Shop (IOSS)

is the electronic portal businesses can use from 1 July 2021 to facilitate VAT e-commerce transactions when shipping internationally. The IOSS VAT identification number consists of 12 alphanumeric characters. By submitting this number, VAT will be collected at the VAT rate of the customer's member state at the point of sale.The benefit to your customers is that they will only be charged at the time of purchase, and will not be met with any surprise import fees when the goods are delivered. If you, the seller, are not registered in the IOSS, the buyer will need to pay VAT alongside a customs clearance fee charged by the shipping carrier.

What have we done?

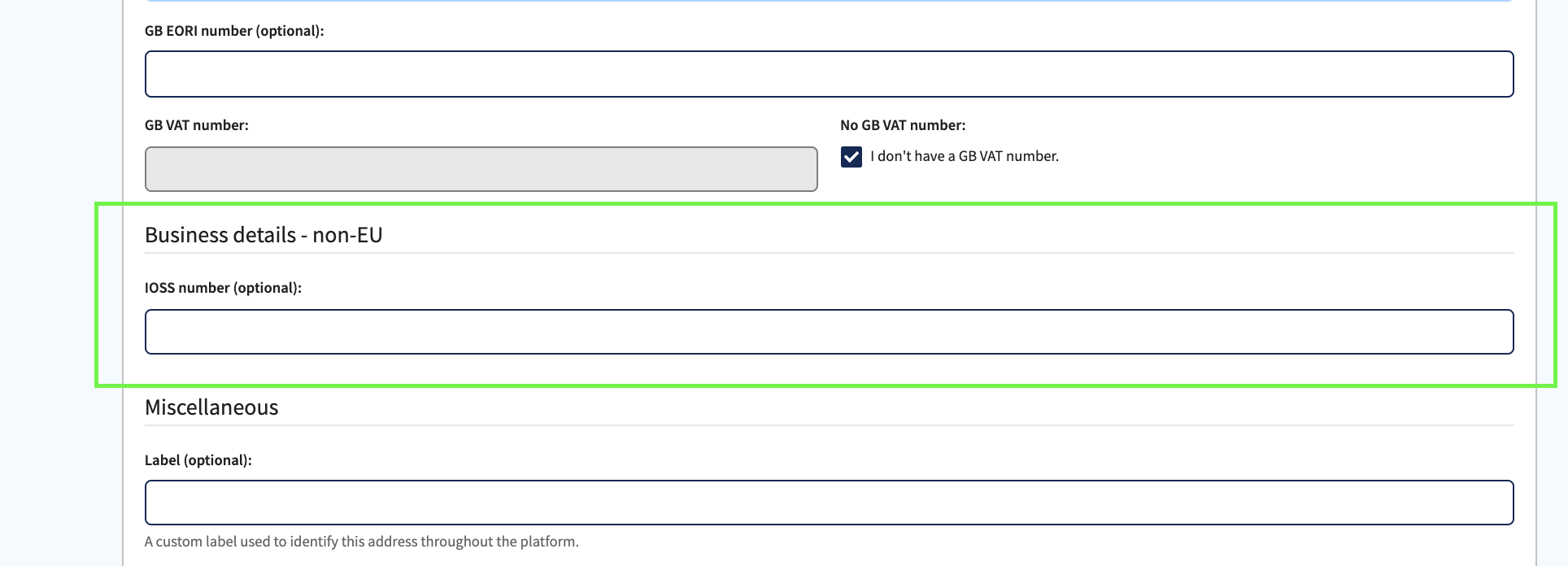

We added a new optional

IOSS configuration field in the address settings

, where our UK merchants can add their IOSS number (see attached screenshot). The IOSS numbers are submitted via the data transfer directly to carriers. They will moreover be shown on the commercial invoices. This article shows you how to add the IOSS number in your address settings.

Updated carrier connections

Mandatory:

- ✅. DPD UK

Non-mandatory:

- ✅. UPS

- in progress:DPD Local, Royal Mail

- planned:Hermes UK, Fedex, DHL Express